Healthcare costs have increased to a whopping 4.6% over the last couple of years. This rise has impacted the revenue collection of providers as well as the overall financial experience of the patients. This rise is keeping the patients from seeing a doctor which can lead to dangerous consequences. Flexible patient payment plans allow patients to pay for their medical services in a manner that is convenient and easy on their budget.

There are certain payment practices for healthcare providers that help their patients to pay their payments in easy installments or as they might see fit

What Are Patient Payment Plans?

Patient payment plans are structured agreements allowing patients to pay their healthcare costs over a specific period rather than in a single lump sum.

These plans can benefit patients facing high deductibles, costly procedures, or uninsured medical expenses. By breaking down a large bill into smaller, more manageable payments, these plans can help reduce financial stress for patients and increase payment reliability for providers.

Why Do Practices Need Patient-Payment Plans?

As discussed above, due to rising healthcare costs there is a growing demand for patient-payment plans. Flexible patient payment plans allow patients to pay for the treatments taken in a more budget-friendly manner.

When we look at the healthcare revenue stats, it’s surprising to know that a huge amount is due in medical bills. According to current research, 45% of Americans have medical debt, which, which means 1 in every 4 Americans have due bills. Now these are alarming figures for healthcare revenue collection management.

These bills are due because the patients are not provided with a way out through a payment plan

Similarly, another recent report states that around four million adults ages 65 and older had $53.8 billion in medical bills in 2020 that they couldn’t pay in full..

Better financial experiences enable the patients to get rid of their due bills which automatically improves the cash flow for the providers. Now, If the patients were provided with better payment plan options, the revenue would have been collected faster without burdening the patient with debt

How can Payment Plans Benefit the Office and the Patient?

When patients take a certain medical treatment that is expensive, it’s almost impossible for them to pay for it in a lump sum

Therefore, when a provider sends them receipts for the services rendered it’s highly impractical for the patients to pay back in full. So it’s a waste of time and energy on the part of the providers

Moreover, healthcare costs are constantly rising and it’s become difficult for patients to afford their treatments. It’s important to note that the rising costs and no payment plans can keep the patients from pursuing care hence resulting in severe medical conditions.

To combat such alarming situations it’s essential for healthcare providers to come up with payment plans.

Here are some reasons how can payment plans benefit the office and the patient:

For the Office

- Improved Revenue Cycle Management

- Reduced Billing Costs

- Improved Cash Flow

- Enhanced Patient Financial Responsibility

- Increased Transparency

For the Patients

- Increased Patient Satisfaction

- Decreased Bad Debt and Write-Offs

- Reduced Financial Stress

Best Practices for Healthcare Providers

Patient payment plans not only lessen the financial burden of healthcare on patients but also ensure a consistent flow of income for healthcare providers.

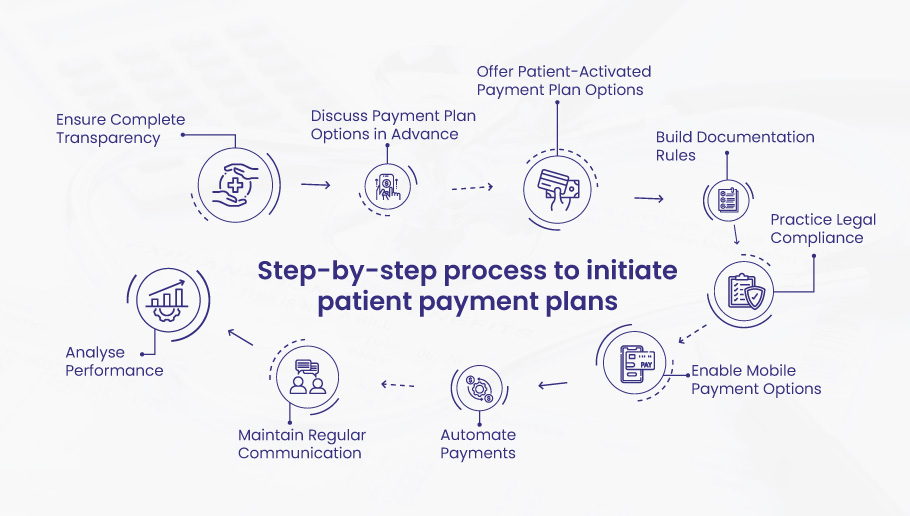

Below are some of the best practices for patient payment plans for healthcare providers.

Ensure Complete Transparency

The first step in implementing a successful patient payment plan is to ensure complete transparency. It’s essential for a strong patient-provider relationship in the long term.

Each patient plan must include the total amount due, the frequency of payments, and any potential interest or penalties

This clarity can prevent any misunderstandings down the line and foster trust between patients and providers. As well as establish the end goal- to keep the finances transparent.

Discuss Payment Plan Options in Advance

It’s always essential to be proactive rather than reactive when making a patient payment plan. Being a healthcare provider you want to discuss payment options with your patient and customize them according to their needs.

Ask your team to communicate effectively and make sure you discuss what payment plan your patients want to pursue. Being kind and understanding about the patient’s situation is the key to better patient-provider communication.

Offer Patient-Activated Payment Plan Options

Offering a patient-initiated payment plan liberates your patients from a strict and difficult-to-follow plan. For example, when a patient is given a flexible time frame that suits his budget and timings, he is more likely to follow it. This makes him financially responsible as well as stress-free.

Generally, patients go for these two plans that are feasible for them as well as affordable.

Installment plans

Some providers go for installment plans and allow their patients to pay a fixed sum at regular intervals until the sum is paid fully.

Recurring/subscription payment plans

Others might choose a recurring option where the patient is charged automatically to their bank account at periodic intervals

Build Documentation Rules

Documenting the rules is crucial to keeping things concise and straightforward for both parties. Once you build documentation rules, the patient is aware of the payment procedure and payment plan.

The contract must be agreed upon beforehand so that there is no glitch down the line. Build rules about upfront payments, installments, and frequency of the payments to be made.

Practice Legal Compliance

Ensure that your payment plan complies with all applicable federal and state laws. It’s advisable to consult with a healthcare attorney to review your plan and ensure it meets all necessary legal requirements.

Enable Mobile Payment Options

Healthcare organizations have witnessed improved collection rates when they enabled self-service or mobile payment options.

It gives the patients the liberty to transfer funds at any time, from any place, and with whatever mode of payment they like.

According to recent research, 61% of patients would consider switching to better payment options.

Offering flexible payment options, such as varying the payment frequency or allowing payments through different methods (credit/debit cards, online payments, etc.), can make the plan more appealing and accessible to a broader range of patients.

Automate Payments

Automating payments can make the process easier for the patient and the provider. By setting up automatic deductions from a patient’s bank account or credit card, you can ensure timely payments and reduce the administrative burden associated with manual payment collection.

It will automate cash flow without manually working on the patient payment.

Maintain Regular Communication

Keeping an open line of communication with patients is vital. Regularly updating patients about their payment status, sending reminders for upcoming payments, and promptly addressing any queries or concerns can enhance patient satisfaction and ensure the smooth operation of the payment plan.

Analyze Performance

Despite proper documentation, communication, and automation, overall analysis is still required to keep track of the payment plan implementation. More collection with fewer distractions should be the ultimate goal.

Proper analysis of the performance provides a beneficial solution that addresses both patients’ financial concerns and healthcare providers’ revenue needs.

Lastly, a complete analysis leads to improved healthcare revenue cycle management, increased patient satisfaction, and reduced billing costs.

How Many Hospitals Offer Patient Payment Plans?

A steady rise observed in hospitals offering patient-initiated payment plans because of the constantly rising costs of healthcare services. For an improved patient financial experience, it’s the need of the hour to offer patient payment plan options. Some of the healthcare providers are collaborating with third-party providers to offer patient-initiated payment plans while some have built in-house plans. Approximately 87% of healthcare providers offer patient payment plans according to research done in 2021.

Being a healthcare provider, practices are always on their feet to provide ease of processing for their patients in each and every manner. Providing payment plan options is one of them. You can reach out to the hospital management to discuss your preferences and desired plan that is both efficient and personalized. In this time and age the quality of service provided is important but offering feasible payment plan options is equally important for an enhanced patient financial experience.

To conclude, patient-initiated payment plans are a vital tool in medical billing. These plans improve the financial health of healthcare providers and enhance the patient experience. Moreover, they offer a win-win solution for all parties involved. At Bellmedex we provide patient-initiated, easy, and budget-friendly payment plans that are automated without involving any administrative work.